Are college costs reaching a breaking point? That’s the headline of a Businessweek article from this past summer, published just about the time when fall tuition payments were due. With two kids in college and a third starting next fall, these types of headlines usually get my attention.

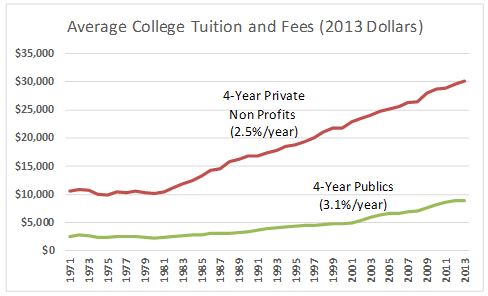

It’s no secret that annual tuition and fees alone at top universities are approaching $50,000, with Columbia University leading the pack at $49,138 for the 2013-2014 school year. According to The College Board, average tuition and fees for four year private non-profit and public colleges increased at an annual compounded rate of 2.5% and 3.1% respectively above the rate of inflation since 1971 (see chart)!

2.5% and 3.1% per year don’t sound like big numbers, but inflation adjusted household median income over that time period only grew from $45,641 to $51,156 or 0.3% per year. For that median wage earner the average private college cost grew from 23% of his/her pretax income to 59%! I would call that a breaking point!

In their recent New York Times column, authors Clayton Christensen and Michael Horn, predict disruptive change coming to higher education in the form of Massive Open Online Courses (MOOCs), which use the internet to deliver classes to thousands of students. Most MOOCs are currently free but don’t provide college credit to participating students. However, that model is gradually changing, as both public and non-profit private colleges have begun offering credit bearing online courses and even full degree programs. As these programs prove their value, we think this trickle of courses will become a torrent of online higher education with cost efficiencies and competition causing prices to drop precipitously.

How should colleges prepare for this impending deluge and avoid getting washed away by price competition? One obvious path is to stop resisting the inevitable and launch their own online credit bearing courses and degree programs. Early adopters will benefit from a lead on the cost reduction learning curve and be better prepared for downward price pressure as competition grows.

Facing only limited competition in the credit bearing online course market, some colleges and universities such as SUNY Empire State and The University of Minnesota are charging the same for online course credits as for their on-campus courses. A more common model is to discount from 25% to 50% off the price of on-campus courses as have Arizona State University and University of Wisconsin. Some of the more aggressively priced programs such as Georgia Tech’s newly announced online master’s degree in computer science are as much as 80%+ less expensive than their on-campus counterparts.

As with any business facing pricing decisions for a new offering that could cannibalize its core business, a college or university choosing the right online course pricing strategy must consider a number of factors including:

- Current competition for both online and on campus students

- Cost structure of the new offering and plans for cost reduction over time

- Selection of courses/degrees to be offered online

- Whether online course pricing will follow the same differential pricing policy as on campus tuition for in state and out of state students (for public colleges only)

- Whether or not the online courses will be offered to international students overseas

If you are dealing with similar pricing challenges, whether you manage a college, a business or a non-profit organization, we can help you navigate your alternatives. Please contact us to discuss how.