Even in the post-Steve Jobs era, Apple is thinking differently from its main competitors – in this case relating to pricing. While at first blush Apple’s rumored pricing for the new iPhone 6 seems to be going against the grain, it is actually following best pricing practices. Judge for yourself….

The media reported that Apple is looking to achieve a $100 increase on the iPhone 6 vs iPhone 5. This seems like a strange move, at a time when its rivals are going down in price.

There are two ways to look at this if you’re Apple: On the one hand, consumers around the world want cheaper phones with bigger screens. This suggests it needs to cut the price and bump screen size. On the other hand, Apple believes (and has shown) to be somewhat insulated to the pricing pressure of Android phone makers. The iPad, for example, was originally going to sell for $400, but Apple figured people would pay $100 more, and it was right.

Apple realizes that price level is an outcome of the following three “ingredients:”

The company is masterful at understanding and quantifying the relationship of its own value created versus competition, and most importantly, the premium value of its brand (brand representing the present yield of previous value creation).

The company is masterful at understanding and quantifying the relationship of its own value created versus competition, and most importantly, the premium value of its brand (brand representing the present yield of previous value creation).

The lesson here is that it is essential to consider ALL elements of value when pricing new products or adjusting price of existing product, not just simplistic comparisons to competitors’ pricing.

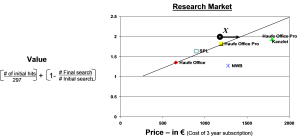

One tool we often use to determine price level is a price value map, which compares relative value delivered to price both for your own products and competitors’ Sounds easy enough, except that determining “value” is hard. To understand the true value delivered requires in-depth qualitative research and quantification through analysis of purchase and usage data.

But the effort is usually worth it as it will avoid unnecessary discounting or market share loss due to over-pricing, or identify opportunities for price increases, as in the example below of a European tax research provider.

For this European content/software provider, a key value driver was the number of hits/against speed of additional filtering. The client company x was determined to be well above the “value line” established by the competitive offers and therefore could (and did) increase price 15% from 1300 to 1500 euros without losing market share.

To find out more about how to construct and use price/value maps, call us at 203-514-0515.

Your Abbey Road Team.

Sorry, the comment form is closed at this time.