Pricing Tools

Broad intellectual capital = a rich array of tools

Price Engines

A price engine is a tool that reflects your industry economics and market price sensitivities to enable line management to make rapid, confident, and accurate price-level decisions. A price engine will allow your company to set the right price (or discount) level to best respond to customer demands, competitive initiatives, or changes in the market.

Price engines can be powered a number of ways. Here are some examples:

Value Analysis – Determines how much value is being created and how much of that value you can capture.

Demand Curves – Show volumes being sold a given price point – usually reveals distinct plateaus, giving guidance to where you want to position your price.

Supply and Demand Curves – First cousin of demand curves – good to figure out broader industry shifts, including industry pricing.

Conjoint and Forced-Choice research – Effective in identifying price elasticities of offer components. Requires that respondents have a good understanding of the choices before them.

Economic Models – Yield management as used by airlines. Or parametric pricing: marriage of statistics and economic models; requires fully understanding price drivers and elasticities.

Historic Pricing – Most commonly used. Easy to implement. Downside is that you could leave money in the table.

Cost-Plus Pricing – Also frequently used. It is inward looking and the downside is that it does not reflect willingness to pay or varying price sensitivities, thereby potentially not capturing full value.

Match Competitor Price – Safe but has flaws: compete for customer’s budget dollars rather than sale. Also, competitor prices are often not easily understood, as they may include rebates, promotional specials, freight charges, warehousing arrangements, financing, etc.

Expert Opinion- Not very scientific, but can be effective. Sales reps often have a good “feel” for the right price levels.

War Games and Scenario planning – Effective but resource intensive. Oil companies routinely use these techniques so they have a response ready when a particular situation arises.

Auctions – Very effective, but often not practical.

Negotiations – Also very effective. Best in complex business-to-business markets. Requires good understanding of price drivers and buying processes.

We have developed many price engines for our clients. Here a few examples:

- For a leading publisher, we developed a price engine to calculate the right discount level based on their customer economics. Those economics varied by size of the customer and the degree to which the customer could recoup its costs from end users.

- For a leading plastics manufacturer, we developed a price engine which compared transportation costs with prevailing market price levels, and so suggested the best geographies for price and sales initiatives.

- For a leading letter delivery organization, we developed a price engine which compared the buyer economics among different classes of service. The model focused on direct-mail customers, and the relative effectiveness (yield) of different delivery services for direct mail campaigns.

- For a leading data communications equipment manufacturer, we developed a price engine which compared the economics of different network topologies and calculated the cost-savings potential for equipment in each situation and tailored prices accordingly.

Bundle Configurator

More than ever, businesses need to bundle multiple products and/or services into one offer. Why? Because technology and cost cutting are creating a world in which customers demand integrated solutions.

Designing the right bundles for the right customer is critical to the success of any business. Our proprietary approach takes bundle analysis to a new level, including the following:

- Bundle types: structured and unstructured

- Bundle taxonomy: core and add-ons

- Measurement of bundle component value, including negative elements

- Linking bundles to customer segments

The benefits of better bundling are material, resulting in anywhere from 25% to 100%, improvements in price levels or volumes.

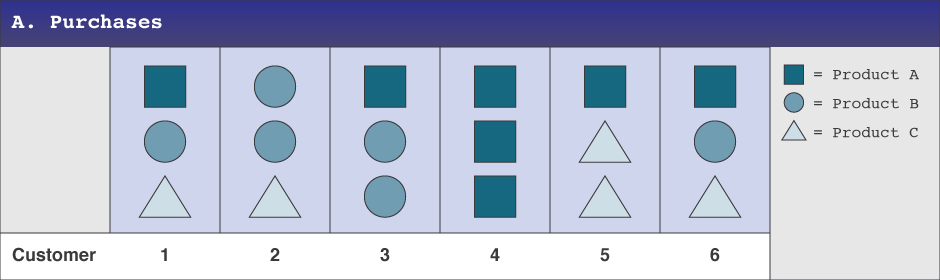

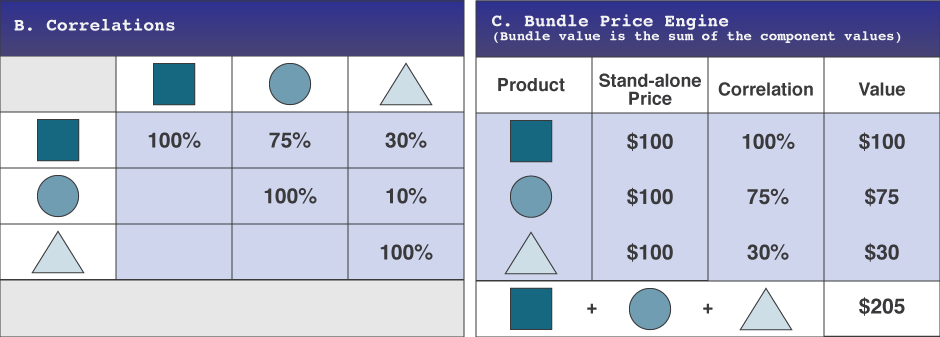

The starting point is how customers buy stand-alone services or products (A). Next, we use correlation analysis to identify purchase patterns and the “core” of bundles. (B). Correlation acts as a proxy for expected value of a bundle (C).

The result of applying this tool are bundles that are optimized in terms of bundle components, with no “negative” bundle elements that might destroy bundle value.

Click here for our white paper on Bundling

Demand Curve

One if the most powerful, yet often under-appreciated, tools in pricing is the demand curve.

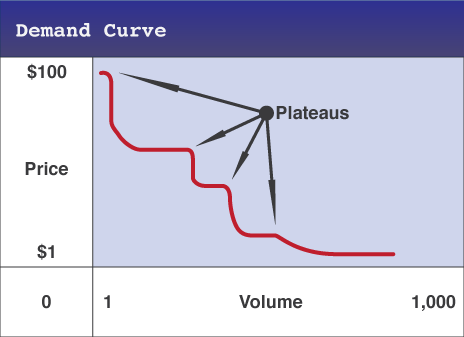

A demand curve shows the volume of product sold at a different price levels. It is constructed using volumes and price levels of the entire market or segment in which your product is competing. In most cases, the curve slops downward, meaning you may sell less at higher prices.

Our experience has shown that often there are distinct plateaus along the curve, showing specific price segments of customers that value products at a common level and are willing to pay a common price.

Knowing your demand curve will help you decide which price segment to enter (or avoid) and how big the overall demand will most likely be at those levels.

Click here for our white paper on Demand Curves

Discount Scorecard

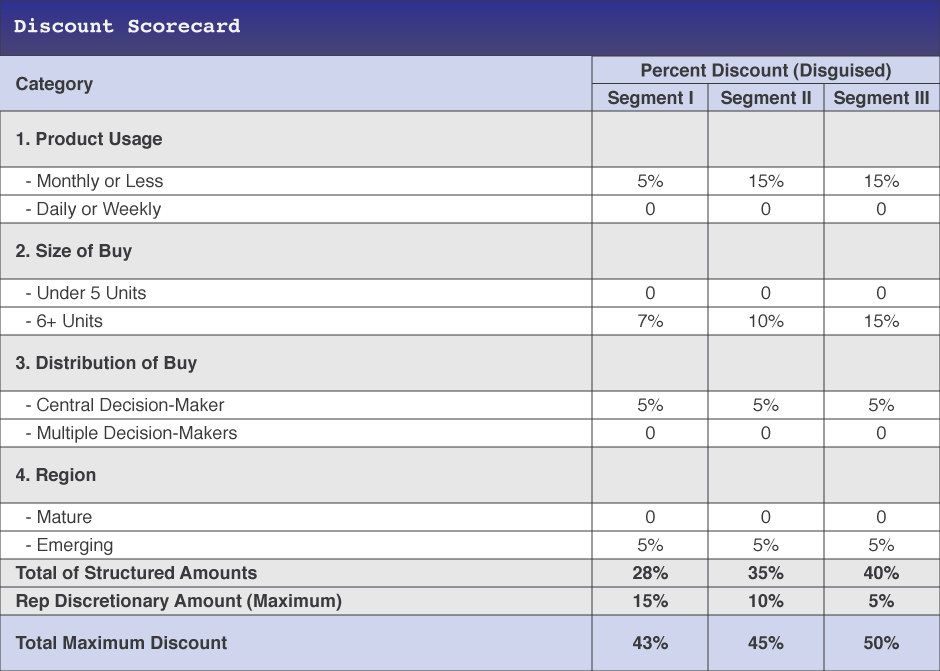

The discount scorecard is a tool that helps Management ensure that the agreed-upon discount strategy is followed by the sales force, while giving flexibility during negotiations.

The tool captures the key variables identified as discount drivers, assigns scores to them in a predetermined manner, and allows for easy score tallying.

This results in a structured, easy way to calculate the discount that should be given in a particular situation.

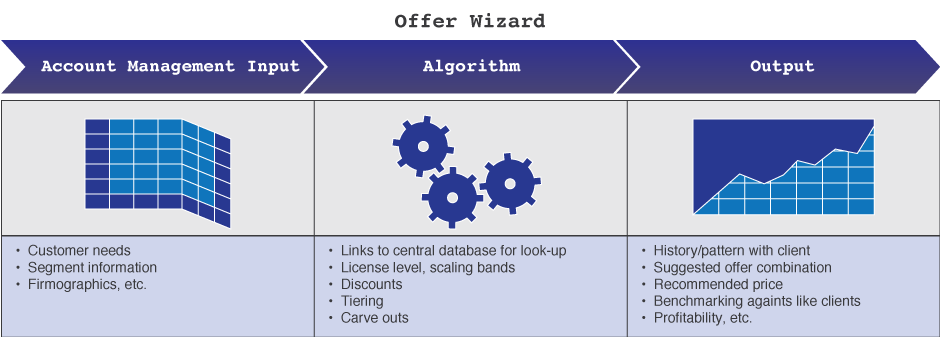

Offer configuration “wizard”

An offer wizard is a tool that automates the often difficult process of designing and pricing a complex offer. It is designed to take inputs from internal systems and account managers/sales reps and calculates the optimal offer and pricing, including discounts, etc. This type of tool is most effective in markets characterized by high value, customized selling, and/or where discipline regarding pricing/discounting has been lacking. If designed right, it will make selling easier and increase your company’s bottom line due to increased revenues and decreased discounting.