I live in New York City where owning a car is a very expensive proposition. Fortunately, for those of us who don’t leave the city for work every day, there are plenty alternatives for getting from point A to point B, so that owning your own car isn’t really necessary. There has always been great public transportation and plenty of taxis available – except of course when it’s raining. Now there are even more options with hourly car rentals like Zip Car, internet-based limo services like Uber and even Citibike, the city’s short term bike rental program.

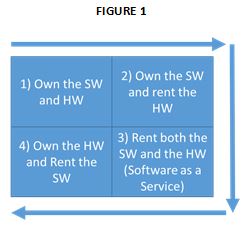

A similar proliferation of pricing models has emerged in the software industry. For decades the only way to acquire enterprise software was to purchase a perpetual license and then pay an additional 18% – 20% of that purchase price every year in maintenance. The owner of that software license would then have to buy the computers, housed in their own data centers on which to run the software. They also needed to hire and train staff to maintain that hardware (upper left quadrant of Figure 1). All these costs added up – like owning your own car in New York City.

With the rapid growth of the internet, the cost of data of communications dropped precipitously, making it economical for companies to outsource their data center operations and run their licensed software remotely. Companies started by renting space in data centers, but over time more and more of the computer infrastructure and maintenance services became available for rent by the month or even by the hour (upper right quadrant of Figure 1).

As internet browsers evolved into sophisticated user interfaces, a few forward looking companies realized they could rent the software and hardware to their enterprise customers both simplifying the sale and shortening implementation times (lower right quadrant of Figure 1). This was a particularly good option for applications like Customer Relationship Management Systems (CRMs) that required easy access to a common database by remote employees such as salespeople, which is how an upstart called Salesforce.com rapidly overtook Seibel the CRM industry leader.

As internet browsers evolved into sophisticated user interfaces, a few forward looking companies realized they could rent the software and hardware to their enterprise customers both simplifying the sale and shortening implementation times (lower right quadrant of Figure 1). This was a particularly good option for applications like Customer Relationship Management Systems (CRMs) that required easy access to a common database by remote employees such as salespeople, which is how an upstart called Salesforce.com rapidly overtook Seibel the CRM industry leader.

With Software as a Service (SaaS) gaining popularity across a broader range of enterprise applications, software market leaders are scrambling to protect their position against upstarts like Salesforce.com by launching their own all inclusive SaaS offerings. Some are providing customers even greater choice with a third option, a software subscription, where customers rent the software and can run it either on their own hardware or in a third party data center (lower left quadrant of Figure 1).

So how does a software company with three licensing models set a competitive, yet profitable price for each? That really depends on where the competitive pressure is coming from. If a company that traditionally sold perpetual licenses plus a maintenance fee is losing market share to a SaaS provider, it makes sense to start with setting a competitive SaaS price to address that threat. Faced with a competitor pricing their SaaS offering at $100 per user per month, the incumbent will need to use that as an anchor, pricing theirs at perhaps $120 per user per month assuming the premium is justifiable. Since the SaaS price includes the computer infrastructure, the software only subscription should be somewhat lower, say $80 per user per month, depending on the value of the infrastructure component.

Finally, setting the perpetual license price should start with the maintenance fee, which would be substantially lower than the subscription only charge. Setting the maintenance fee at $30 per user per month implies a perpetual license price of $1,800 per user assuming an annual maintenance charge of 20%, since 20% of $1,800 = $360 / 12 months = $30 per month. The buyer then has the option of paying $1,800 up front plus $360 per year per user or $960 per year per user ($80 x 12). Since the breakeven point with these prices is exactly 3 years, all other things being equal, a buyer who expects to use the software for more than 3 years would choose the perpetual pricing option.

Pricing in the real world is never that simple. Many other factors will influence the pricing decision including the average life of a customer, the cost of capital for both the seller and buyer, buyer preference for using its operating or capital budgets to acquire the software, and of course, discounting. At Abbey Road Associates, we consider all of these factors when helping a software vendor navigate the re-pricing process. We also create a clear transition to the new pricing plan for existing customers who might otherwise feel left out and be more apt to defect to the competition. If the complexity of software pricing is keeping you up at night, give us a call. We may be able to help you get some sleep and stay competitive.