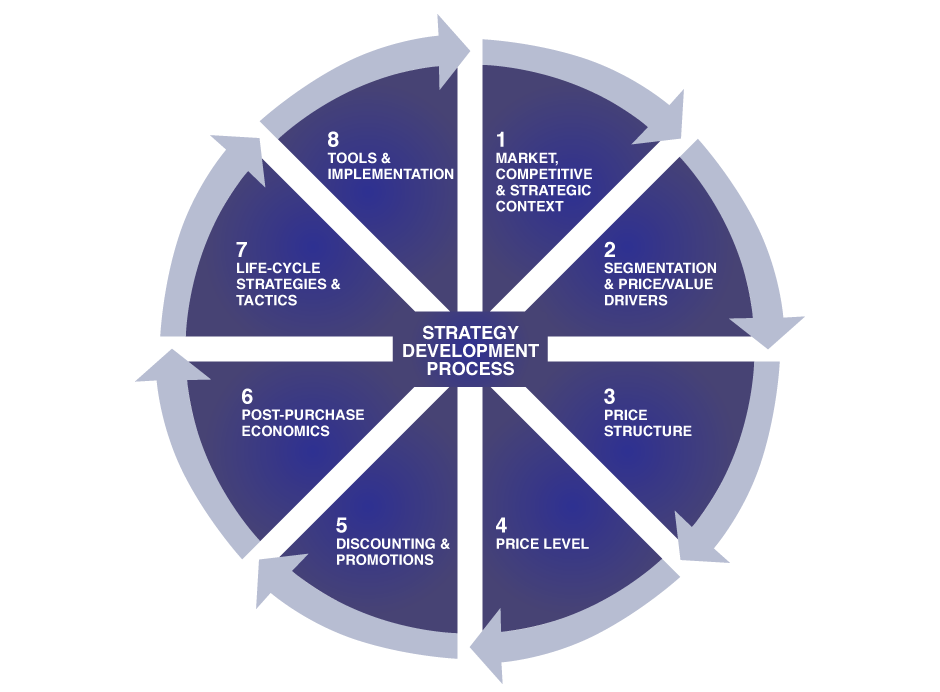

Our Process

Effective pricing strategy is comprehensive, holistic, and contextual

Developing a successful pricing strategy is complex and needs to be approached holistically. All elements of the pricing and marketing mix need to work together. Our process is rigorous and driven by a deep understanding of all pricing levers:

In a typical consulting assignment, we cover each element of the above 8-step strategy development process. Below is a short exposition of each:

1. Market, Competitive & Strategic Context

We start with immersing ourselves into your business, and gaining a clear understanding of your markets, competitor landscape, customers, and positioning and corporate strategy. The goal is not only to understand the market and your business, but also to identify value-capture opportunities that can be monetized via contextual pricing strategies.

Contextual pricing strategies reflect that buyers are influenced more by comparison points and contextual messages than by actual price levels – as Arthur Miller famously said in his 1968 play The Price, “Without a story I cannot give you a price. The price of used furniture is a point of view.”

Contextual pricing is our guiding principle, or lens, through which we view and develop all price strategies. For a more in-depth discussion on this topic, see our book: Contextual Pricing (McGraw-Hill 2012).

2. Segmentation & Price/Value Drivers

Price Segmentation divides the market or your customer base into segments that have different price sensitivities. To identify these segments we ask the following questions:

- Which customer groups are more or less price sensitive?

- What drives these differences in price sensitivity?

- How do differences in context drive different levels of price sensitivity?

We call the latter Price/Value Drivers. There can be many potential Price/Value drivers, but we usually find that 2-3 key drivers make a difference in actual purchase behavior.

Developing a robust price segmentation requires in-depth qualitative work (interviews, focus groups, etc.) and rigorous analysis of purchasing and/or usage data. Some of the qualitative factors we analyze are:

- Who uses the product/service? Who makes the purchase decision? Who influences the decision?

- What are the purchase decision processes (e.g., central purchasing department RFP vs. end user buys with credit card)? How are these different among segments?

- How do the different segments want to buy and be charged?

- How is value measured? What are the criteria for choosing one product/service over another? What are the differences among different customer groups?

3. Price Structure

Price Structure is how to charge for a product or service (as opposed to how much, which is Price Level). This is the most important and far-reaching pricing decision that needs to be made, as it needs to be segment–specific and cannot easily be changed without upsetting the market. Price structure addresses the following questions:

- What should be the fundamental Unit of Measure by which we charge? A simple example is charging by day vs. by mileage.

- Shall we offer the product/service for a Fixed Price, Variable Price, or a combination of the two? In general, customers who use a lot of a product or service prefer a fixed (“all-you-can-eat”) structure, while sporadic users prefer variable (“by-the-drink”) pricing.

- Shall we create a Bundle of products/services, sell them stand-alone, or both? What is the optimal bundle price? Abbey Road has a patented bundle pricing methodology to answer these questions.

- Shall we have price Tiers for our products or service, which vary by usage, number of users, or other Scaling Metrics? One example of a tiered price structure is when Cable TV providers offer different programming at different price points.

In addition to these fundamental price structure decisions, there are various tactical structure options such as Conditions, Hooks, Add-ins, etc.

4. Price Level

Price Level is how much to charge for a product or service, and is an outcome of the steps outlined above. Good price level setting distinguishes between segments and is based on the effective use of a “price engine” (discussed later under Services/Tools). Some of the questions to ask are:

- Is your business capturing the full value of your goods or services?

- Is your business achieving the necessary margins?

- Should you be raising prices, but face resistance and customer defections?

- Are competitors gaining share by under-pricing you?

- Have we maximized the contextual opportunities among all our segments?

5. Discounting & Promotions

The purpose of promotions, discounting, rebates, etc. is to adjust for temporary differences in price sensitivities and to drive specific short-term behaviors, not to replace segment-differentiated price structures and levels. This is a mistake we have observed many times, and it’s reflected in what many sales managers have told us: “Our price list is meaningless. We discount as much as we need to not lose a customer.” If this sounds familiar, it’s time for an overhaul of your pricing strategy, not more discounts!

6. Post-Purchase Economics

Post-Purchase Economics refers to pricing-related programs after the sale has been made, such as satisfaction guarantees, customer loyalty programs, etc. It also includes the pricing impact of a client’s ability to “charge back” the cost of a purchase to a third party after the purchase, such as law firms charging back legal research cost. We have found that this makes a significant difference in price sensitivity and purchasing behavior.

7. Life-cycle Strategies & Tactics

Here we develop specific strategies and tactics that leverage the understanding of how customers evolve over time when buying a new product or service, or migrate to a new product or service delivery method, e.g., online platform. There are three areas we We divide these strategies into the following three segments:

- Introductory pricing strategies

- Migration strategies

- Retention/loyalty strategies

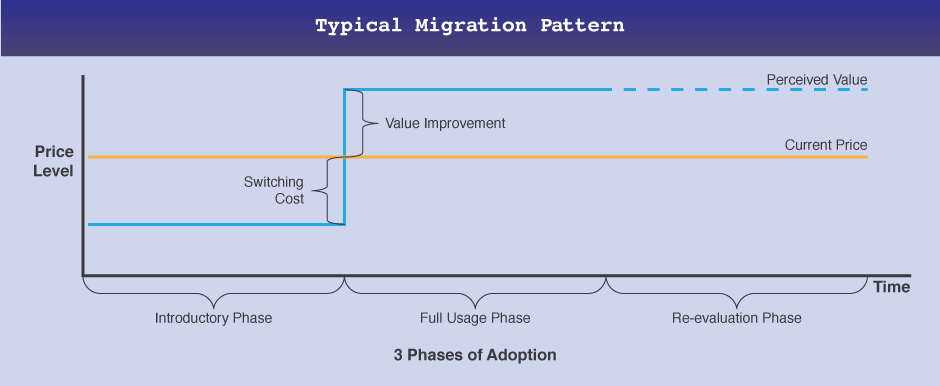

The framework for these strategies is that customers usually go through three phases of adoption (see below illustration):

- . Introductory phase: In this phase, users are learning how to use a new product or service. Initial efficiency may go down due to the learning curve, incurring a “switching cost.”

- . Full Usage Phase: Once users are comfortable with the new product/services, they will recognize the improved benefits/functionalities. This may allow for a price increase to capture the increased value.

- . Re-evaluation Phase: After a period of full usage, the customer has become very familiar with the product/service and may take the enhanced value for granted. In this re-evaluation phase the customer may explore cheaper alternatives and becomes at-risk of canceling/switching. Specific strategies are needed to prevent customers from defecting during this “dangerous” phase.

8. Tools & Implementation

In this phase, we create tools for use by management and/or the sales team. These software tools include:

- Bundle configurator

- Price engine

- Discount scorecard

- Offer “wizard”

For a more in-depth description of these tools, go to: Resources: Pricing Tools.

We also often assist management with implementation and improving Pricing Capabilities, which refers to the organizational structure, processes, and management actions required to manage pricing on a day-to-day basis, as well as how to communicate and enforce the price with customers (and the sales force). Some of the threshold questions to ask are:

- Are you having a hard time executing on your pricing objectives? For instance, do you find it hard to change price levels rapidly and selectively to meet competition?

- Is discounting out of control?

- Do each of the international offices “do their own thing” when it comes to pricing?

- Is your sales force reluctant to sell at a premium price?

- Is your IT infrastructure blocking new marketing initiatives?

- Is there too much guesswork on pricing?

- Do you not feel confident about upcoming price changes and market challenges?

Pricing capabilities are important – without action, any strategy is just theory!